death checklist pdf

Summary

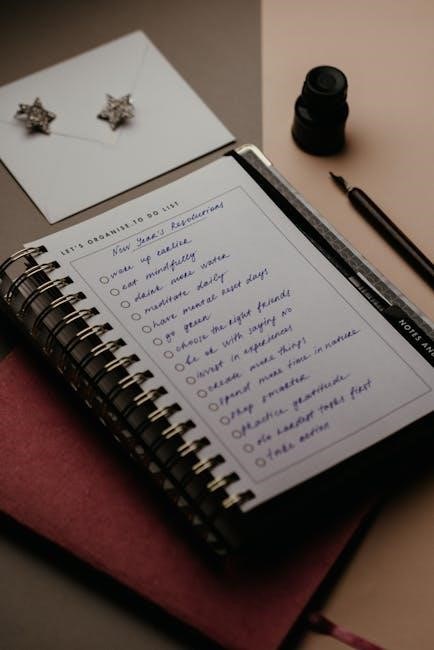

Plan ahead with our comprehensive death checklist PDF. Get organized, ensure peace of mind, and download your free guide today!

A death checklist is a comprehensive guide to help navigate the complex tasks following a loved one’s passing, ensuring organization and peace of mind during difficult times․

Purpose and Benefits of a Death Checklist

A death checklist simplifies the complex process of handling a loved one’s affairs, reducing stress and ensuring no critical tasks are overlooked․ It provides a structured approach to legal, financial, and personal responsibilities, helping families stay organized․ The checklist also offers emotional support by guiding users through difficult decisions, ensuring timely notifications, and facilitating collaboration among family members during a challenging time․

Importance of Organization and Planning

Organization and planning are crucial when dealing with the aftermath of a death․ A structured approach ensures all legal, financial, and personal responsibilities are addressed, reducing stress and emotional overload․ Proper planning helps maintain accountability, prevents oversights, and facilitates collaboration among family members․ It also aids in managing timelines, budgets, and complex paperwork, providing clarity during an otherwise overwhelming time․

Immediate Actions After Death

Secure the location, obtain a pronouncement of death, and notify close family and friends to ensure a structured start to the necessary processes and arrangements․

Obtaining a Pronouncement of Death

Obtaining a pronouncement of death is the first critical step, requiring a doctor or coroner to certify the passing․ This official declaration is essential for securing a death certificate, a vital document for legal and administrative processes․ If death occurs at home, contacting a local authority or coroner is necessary to initiate the formal process․ This step ensures the proper documentation needed for funeral arrangements and estate matters․

Securing the Deceased’s Location and Belongings

Securing the deceased’s location and belongings is crucial to prevent theft or damage․ If the death occurs at home, ensure the property is locked and valuables are safeguarded․ Consider having someone trusted stay at the residence during the funeral to prevent potential burglary․ Additionally, gather and inventory personal items, especially important documents, to ensure they are protected and accounted for during this sensitive time․

Notifying Family and Close Friends

Notifying family and close friends is a sensitive task that requires care and empathy․ Consider enlisting the support of another family member or trusted individual to share the responsibility․ A checklist can help ensure all important contacts are reached and updated․ Prioritize immediate notifications and handle more distant connections as time allows, maintaining clarity and compassion throughout the process․

Funeral and Memorial Arrangements

Plan the funeral or memorial service, handle costs and payments, and create an obituary and memorial website to honor the deceased and provide closure to loved ones․

Planning the Funeral or Memorial Service

Coordinate with a funeral home to arrange the service, considering the deceased’s preferences for burial or cremation․ Determine the date, location, and type of ceremony, and involve family in decisions․ Review pre-planned funeral arrangements if available․ Ensure personal touches, such as music, readings, or eulogies, are included to honor the deceased’s life and provide comfort to mourners․

Handling Funeral Costs and Payments

Obtain detailed cost estimates from funeral homes and review payment options, such as insurance policies or estate funds․ Ensure all expenses are itemized and agreed upon in writing․ Consider pre-paid funeral plans if available․ Allocate funds carefully to cover ceremony, burial, and related costs, while keeping records for future reference and potential reimbursements from benefits or the estate․

Creating an Obituary and Memorial Website

Compile essential information for the obituary, including biographical details, service arrangements, and survivor names․ Use online templates or funeral home services to draft and publish the obituary․ Create a memorial website to share stories, photos, and condolences, allowing others to contribute․ Ensure the obituary is distributed to newspapers and online platforms, and link it to the memorial site for broader accessibility and remembrance․

Financial and Legal Considerations

Obtain a death certificate, review the will and estate documents, and address probate․ Ensure all taxes, debts, and financial obligations are settled, consulting professionals as needed for guidance․

Obtaining a Death Certificate

Obtaining a death certificate is a critical step, typically handled by a medical professional or funeral home․ It is required for legal processes, including probate, insurance claims, and estate administration․ Ensure multiple copies are obtained, as they are needed for various official purposes․ The certificate provides essential details about the death, such as the cause, date, and location, making it a vital document for all legal and financial proceedings․

Reviewing the Will and Estate Planning Documents

Reviewing the will and estate planning documents is essential to understand the deceased’s wishes and ensure proper distribution of assets․ Locate the will, trusts, and any estate plans․ Verify the appointed executor and beneficiaries․ Consult with legal professionals to guide the probate process and address any complexities․ This step ensures compliance with legal requirements and honors the deceased’s intentions, preventing potential disputes among heirs․

Probate and Estate Administration

Probate involves submitting the will to the court for validation and appointing an executor or administrator․ This process ensures the estate is managed according to legal requirements․ Tasks include inventorying assets, paying debts, and distributing remaining assets to beneficiaries․ Proper documentation and court oversight are crucial to avoid disputes and ensure compliance with the deceased’s wishes and legal standards․

Handling the Deceased’s Assets

Securing and managing the deceased’s belongings, real estate, and financial assets is crucial․ This involves inventorying property, overseeing securities, and ensuring proper distribution according to legal and estate guidelines․

Inventory of Personal Property and Assets

Creating a detailed inventory of the deceased’s personal property and assets is essential․ This includes listing household items, jewelry, documents, and financial records․ Documenting each item ensures proper distribution according to legal requirements․ Appraisals may be needed for valuables․ Organizing and updating records helps prevent oversights and ensures clarity for estate administration and distribution․

Managing Real Estate and Securities

Managing real estate and securities involves securing property deeds, identifying ownership, and determining if ancillary administrations are needed for out-of-state properties․ For securities, locate stocks, bonds, and mutual funds, and review Buy-Sell Agreements if the deceased was involved in a business․ Professional advice is crucial for complex situations, ensuring assets are managed and distributed according to the estate plan․

Closing Bank Accounts and Safe Deposit Boxes

Closing bank accounts and safe deposit boxes requires presenting the death certificate to the bank․ Remove valuables and documents, documenting contents with witnesses․ Transfer funds to the estate account for probate․ Ensure all accounts are properly closed and assets distributed as per the will or estate plan, maintaining detailed records for transparency and accountability․

Government and Institutional Notifications

Notify Social Security, benefit agencies, and relevant government institutions about the death․ Update records and IDs, ensuring proper documentation and cessation of benefits or services․

Contacting Social Security and Benefit Agencies

Contact Social Security to report the death and stop payments․ Inform other benefit agencies and government institutions․ Provide death certificates and necessary documentation․ Apply for survivor benefits if eligible․ Ensure proper cessation of payments to avoid overpayment issues․ Update records to reflect the death accurately․ This step helps maintain financial integrity and ensures benefits are appropriately managed․

Notifying Banks, Creditors, and Financial Institutions

Notify banks and financial institutions about the death to secure accounts and prevent unauthorized transactions․ Provide death certificates and identification documents․ Close or convert joint accounts, and consolidate balances as needed․ Inform creditors and lenders to avoid late payments or penalties․ Request hardship programs if necessary․ Ensure debts are managed or settled according to the estate plan․ This step protects the estate and maintains financial stability․

Updating Government Records and IDs

Update government records and IDs to reflect the death, preventing fraud and ensuring proper administration of benefits․ Notify Social Security, National Insurance, and local authorities; Return passports, driver’s licenses, and other IDs to the relevant agencies․ Update property records and voter registration․ Inform the Bereavement Register to remove the deceased from mailing lists․ This step ensures legal accuracy and prevents identity theft or misuse of the deceased’s information․

Emotional and Support Resources

Emotional and support resources provide access to grief counseling, support groups, and professional guidance, helping individuals cope with loss and find comfort in challenging times․

Grief Counseling and Bereavement Support

Grief counseling and bereavement support provide emotional guidance for individuals navigating loss․ Professional therapists, support groups, and helplines offer a safe space to process emotions and find comfort․ These resources help individuals cope with their grief, address mental health needs, and gradually rebuild their sense of purpose and well-being during a challenging time․

Connecting with Support Groups and Communities

Joining support groups and communities can provide comfort and understanding during bereavement․ These groups offer shared experiences, practical advice, and emotional support, helping individuals feel less isolated in their grief․ Online forums, local meetups, and specialized organizations cater to diverse needs, fostering connection and healing among those who have experienced loss․

Long-Term Financial Planning

Long-term financial planning involves reviewing the estate, managing assets, and ensuring a sustainable financial future that honors the deceased’s wishes and supports survivors’ ongoing needs․

Settling Debts and Financial Obligations

Settling debts involves identifying all financial obligations, notifying creditors, and ensuring payments are made from the estate․ Prioritize secured debts, such as mortgages, and handle unsecured debts like credit cards․ Protect the estate by avoiding unnecessary expenses and ensuring debts are resolved before distributing assets to beneficiaries․ Legal guidance may be needed to address complex or contested claims․

Understanding Tax Implications and Filing Requirements

Understanding tax implications is crucial to ensure compliance and avoid penalties․ File the deceased’s final income tax return, and consider filing a joint return if applicable․ Estate taxes may apply, depending on the estate’s value․ Consult a tax professional to navigate federal and state requirements, ensuring all deadlines are met and potential tax benefits are maximized․ Proper documentation is essential for accurate filings․

Closing Accounts and Finalizing Affairs

Closing accounts and finalizing affairs involves canceling subscriptions, settling debts, and closing bank accounts․ Ensure all financial obligations are resolved to prevent further charges or penalties․

Canceling Subscriptions and Services

Canceling subscriptions and services is crucial to avoid unnecessary charges․ Review all recurring payments, including utilities, streaming services, and memberships․ Notify providers with a death certificate to terminate accounts․ Update joint accounts and transfer services as needed․ Monitor for unauthorized charges and close digital subscriptions, such as social media and email accounts, to protect privacy and finalize affairs responsibly․

Handling Unpaid Bills and Claims

Handling unpaid bills and claims requires careful review of the deceased’s financial records․ Identify all outstanding debts, prioritize essential payments, and notify creditors with a death certificate․ Negotiate payment plans if needed and ensure claims against the estate are settled․ Avoid unnecessary delays to prevent legal complications and protect the estate’s assets from undue stress․

Organizing Personal Belongings

Organizing personal belongings involves inventorying assets, categorizing items for distribution, and securing valuables․ Ensure all property is accounted for and stored safely to honor the deceased’s wishes․

Distributing Personal Items and Heirlooms

Distributing personal items and heirlooms requires careful consideration of the deceased’s wishes, often outlined in their will or estate documents․ Begin by inventorying all belongings, noting sentimental or financial value․ Notify beneficiaries of their allocations and handle disputes sensitively․ Consider creating a fair distribution plan, especially for items with emotional significance․ Keep detailed records of each distribution to ensure transparency and legal compliance․

Managing Digital Assets and Accounts

Managing digital assets and accounts involves securing login credentials, canceling subscriptions, and handling email and social media profiles․ Locate password managers or written records to access accounts․ Determine if accounts should be memorialized, closed, or transferred․ Ensure digital assets like photos and documents are backed up and distributed according to the deceased’s wishes․ Consider consulting with tech experts for complex situations․

Creating a Memorial or Legacy

Plan a meaningful memorial or donation in honor of the deceased, such as a scholarship or charity fund, to celebrate their life and legacy․

Planning a Memorial Service or Donation

Organize a meaningful memorial service or donation to honor the deceased․ Decide on the type of service, location, and budget․ Choose speakers, music, and readings․ Designate donations to a charity or cause the person supported․ Consider creating a memorial website or fund to collect contributions․ This thoughtful planning ensures their legacy lives on while providing comfort to loved ones․

Establishing a Scholarship or Charity Fund

Consider creating a scholarship or charity fund in the deceased’s name․ Choose a cause they supported or a field they were passionate about․ Set up the fund through a nonprofit or educational institution․ Gather donations and manage contributions transparently․ Designate a trusted individual or organization to oversee the fund, ensuring their legacy continues to benefit others and inspire positive change in the community․